One of our new year’s resolutions was to keep track of our

spending and maintain budgets. So since we’re almost half way

through the year I thought I’d give an update on this goal. I’m pleased to

report that Zach and I are rocking this goal thanks to mint.com.

Note: the rest of this post is going to be a huge

advertisement for mint.com

This goal is huge and kind of involved, so I’ve broken it

out into steps:

1. Track spending

So before you can set budgets and keep an eye on spending,

first you need to track it. Thankfully these days most purchases are made with

a credit or debit card, so it’s easy to track everything electronically. We

created a free account with mint.com and linked all of our financial accounts to

their system. Mint.com just compiles all of our accounts into one interface so

we can track all of our financial activity in one place.

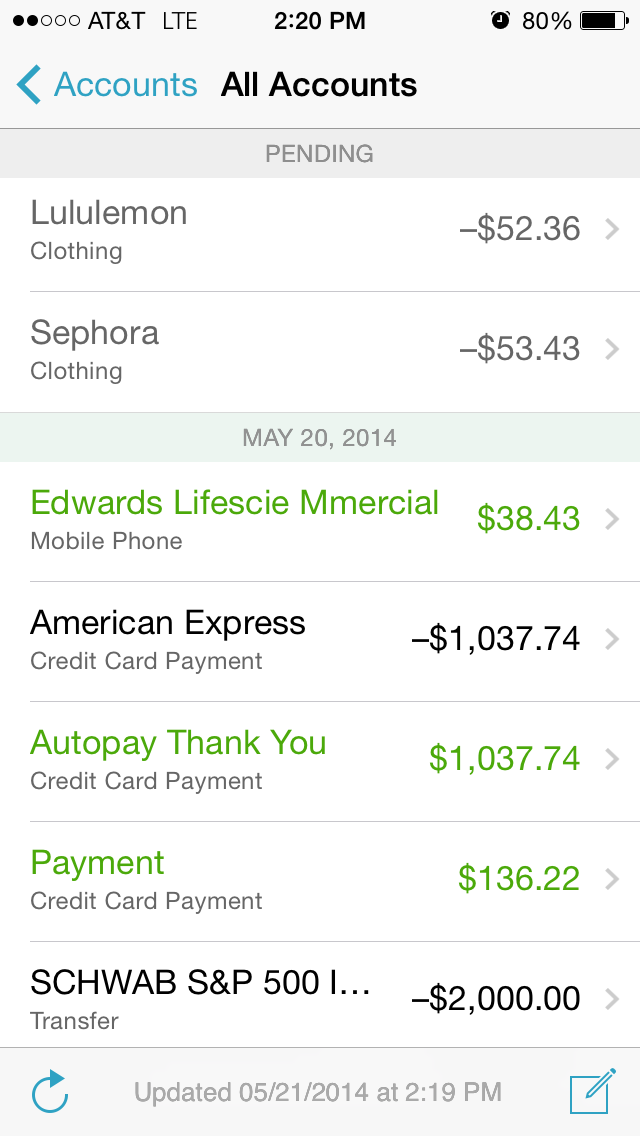

All transactions come in automatically and are divided up by date. The green ones stand for money coming in and the black ones are money going out. You can see the credit card payment above has two transactions, one in black for the money leaving our checking account and one in green for the payment being received by the credit card account.

2. Categorize Spending

This is where things get a little more difficult. Tracking

spending is easy, but in order to make that tracking data valuable, you really

need to categorize each transaction. This allows you to keep track of how much

you’re spending on home stuff versus clothes, food, eating out, etc. Luckily mint.com makes this super easy, but

you have to pretty vigilant about keeping track of the categorizations, otherwise

you’ll get a month behind and then forget what that one thing you bought on

Amazon was.

I installed the mint.com app on my phone and I’ve made it a

habit to check it daily and categorize any new transactions. Mint actually

starts to learn the categories (like gas stations are always gas and Trader

Joe’s is always groceries). I only need

to provide a category for things Mint gets confused about, like Target and

Amazon (where sometimes I buy cleaning supplies, or groceries, or clothes) and

new places Mint doesn’t know about yet.

Mint also has this nifty thing that allows you to split one transaction into multiple categories. Check it out:

3. Set Budgets

The first transaction is one purchase that was split into three categories (pet, home stuff, groceries). I keep track of this by pinning receipts that need splits on the fridge and I don't take them down until I've logged the transaction in mint.

Once you start categorizing everything, you can look at cool charts like this that show you where your money is going.

The only tricky thing to categorize is cash. We rarely use cash, so when we take it out I just categorize that ATM withdraw to what I think we'll spend that cash on (usually a split between entertainment, restaurants, and travel).

3. Set Budgets

After you’ve been categorizing for awhile (probably 3 months

minimum) you’ll have enough data to start setting budgets – it’s good to wait

and see how much you’re spending on everything before trying to set budgets,

otherwise you might be setting them way too high or low. Zach and I set budgets

for the following categories: Entertainment, Groceries, Restaurants, Gifts/Donations,

Sports, Furnishings, Home Supplies, Tessa Clothing, Tessa Personal, Zach

Clothing, Zach Personal, and Travel. We picked these categories because they are

all areas we can control with our day-to-day spending decisions. We don’t

bother tracking things like gas or utilities, since those costs are kind of

set. Mint.com has an awesome

budget tracking tool. You just load in what categories you want to budget

for, set a monthly amount, and it keeps track of your budgets for you. Also, you can set the budgets to roll-over, so if you don't spend all of the money in one month, you get more the next month.

Here's a look at our budgets right now. The app does a good job of showing you how you're tracking to your spending goals.

Final Thoughts

If you've been wanting to get your spending on track but have been overwhelmed by the task of tracking stuff and setting budgets, I encourage you to try using mint.com for a few months. At first I was hesitant because it seemed like a lot of work, but with the app on my phone it's easy for me to review stuff every day (also, this is a great way to catch fraudulent charges early). Since Zach and I have been tracking our budgets, our spending has gone way down, but I don't feel like we're deprived of anything. We both have generous personal budgets, entertainment, and travel budgets, so I never feel like there's something I want that I can't have, I just need make sure it's charged against the right category.. No more crazy guilt after buying an expensive top from Lululemon and no more agonizing over whether I should buy new bar stools or not - now I just check the budgets, make the decision, and move on.

Also, mint.com has these awesome charts where you can track your net worth over time, spending by month, year, category, etc. If you are really into charts like Zach and me, you'll love it.

No comments:

Post a Comment